Is Your Commercial Vehicle Insured to Cover Its Current Value?

As a truck owner-operator, your vehicles are essential to your success. Whether you own, finance or lease your trucks – or have a mix of these arrangements – understanding how your insurance policy values them is crucial. With the proper amount of insurance coverage, you can help protect the value of your trucks, and your company’s financial health, if an accident occurs.

Stated value vs. Actual cash value

Insurance companies use two primary methods to determine a truck's value: stated value and actual cash value. Knowing the difference between these can help you make informed insurance decisions and safeguard your vehicle’s value if it’s damaged or completely lost in an accident.

- Stated value. This is the value you declare for your truck in your insurance policy. It should reflect the truck's current market value at the time the policy is written.

- Actual cash value. This is the truck's market value at the time of the loss, considering depreciation.

When an accident claim is filed, insurers pay the lesser of these two amounts. For truck owners, this distinction is critical. If the stated value in your policy is outdated, your truck may be underinsured, potentially leaving you to cover repair costs or replace the truck out of pocket in the case of a total loss.

Coverage for owned and leased commercial vehicles

- Owned trucks. Depreciation will continue to lower the value of your truck from the moment it drives off the lot. Being certain the stated value in your policy is up to date can help you receive the correct payout for repairs or replacement if an accident occurs.

- Financed or leased trucks. Trucks often depreciate faster than the remaining balance on a loan or lease. This could leave you owing more than the insurance payout if the truck experiences a total loss. To mitigate this risk, consider insurance coverage – often called “financed value” or “gap” coverage – that includes the difference between the actual replacement value and the financed amount.

Insuring your commercial fleet

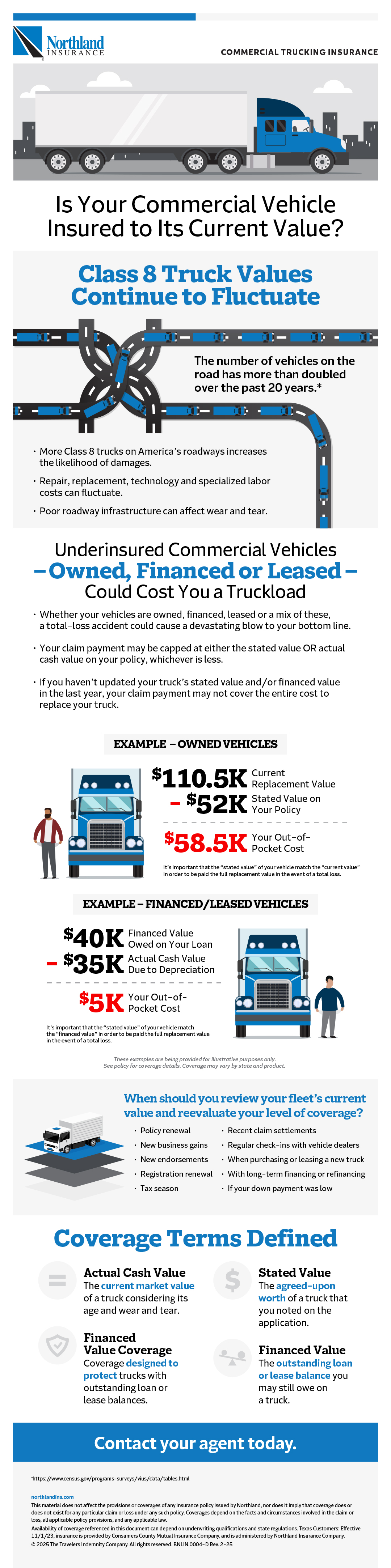

The infographic below highlights key factors and trends to help you make sure your commercial trucks are properly insured to their replacement value. By understanding these differences and regularly updating your policy, you can protect your business from unexpected financial burdens if an accident occurs.

Northland Insurance – Commercial Trucking Insurance

Is Your Commercial Vehicle Insured to Its Current Value?

Class 8 Truck Values Continue to Fluctuate

The number of vehicles on the road has more than doubled over the past 20 years.*

- More Class 8 trucks on America’s roadways increases the likelihood of damages.

- Repair, replacement, technology and specialized labor costs can fluctuate.

- Poor roadway infrastructure can affect wear and tear.

Underinsured Commercial Vehicles – Owned, Financed or Leased – Could Cost You a Truckload

- Whether your vehicles are owned, financed, leased or a mix of these, a total-loss accident could cause a devastating blow to your bottom line.

- Your claim payment may be capped at either the stated value OR actual cash value on your policy, whichever is less.

- If you haven’t updated your truck’s stated value and/or financed value in the last year, your claim payment may not cover the entire cost to replace your truck.

Example – Owned Vehicles:

$110.5K (Current Replacement Value) minus $52K (Stated Value on Your Policy) equals $58.5K (Your Out-of-Pocket Cost)

It’s important that the “stated value” of your vehicle match the “current value” in order to be paid the full replacement value in the event of a total loss.

Example – Financed/Leased Vehicles:

$40K (Financed Value Owed on Your Loan) minus $35K (Actual Cash Value Due to Depreciation) equals $5K (Your Out-of-Pocket Cost)

It’s important that the “stated value” of your vehicle match the “financed value” in order to be paid the full replacement value in the event of a total loss.

These examples are being provided for illustrative purposes only. See policy for coverage details. Coverage may vary by state and product.

When should you review your fleet’s current value and reevaluate your level of coverage?

- Policy renewal

- New business gains

- New endorsements

- Registration renewal

- Tax season

- Recent claim settlements

- Regular check-ins with vehicle dealers

- When purchasing or leasing a new truck

- With long-term financing or refinancing

- If your down payment was low

Coverage Terms Defined

Actual Cash Value: The current market value of a truck considering its age and wear and tear.

State Value: The agreed-upon worth of a truck that you noted on the application.

Financed Value Coverage: Coverage designed to protect trucks with outstanding loan or lease balances.

Financed Value: The outstanding loan or lease balance you may still owe on a truck.

Contact your agent today.

*https://www.census.gov/programs-surveys/vius/data/tables.html

northlandins.com

This material does not affect the provisions or coverages of any insurance policy issued by Northland, nor does it imply that coverage does or does not exist for any particular claim or loss under any such policy. Coverages depend on the facts and circumstances involved in the claim or loss, all applicable policy provisions, and any applicable law.

Availability of coverage referenced in this document can depend on underwriting qualifications and state regulations. Texas Customers: Effective 11/1/23, insurance is provided by Consumers County Mutual Insurance Company, and is administered by Northland Insurance Company.

© 2025 The Travelers Indemnity Company. All rights reserved. BNLIN.0004-D Rev. 2-25

Protect the value of your trucks

To help safeguard your business, take these proactive steps to align your insurance coverage with the current value of your vehicles:

- Regularly review your insurance policy.

- Stay informed about how depreciation affects your fleet’s value.

- Consider financed value coverage for financed or leased trucks.

In addition, explore how physical damage insurance from Northland – which includes financed value coverage at no extra cost – can help safeguard your owned, financed and/or leased trucks from accident-related losses.

Speak with a Northland agent now to discover all your truck insurance options and customize them to your current needs and future plans.